Introduction to Sustainable Finance

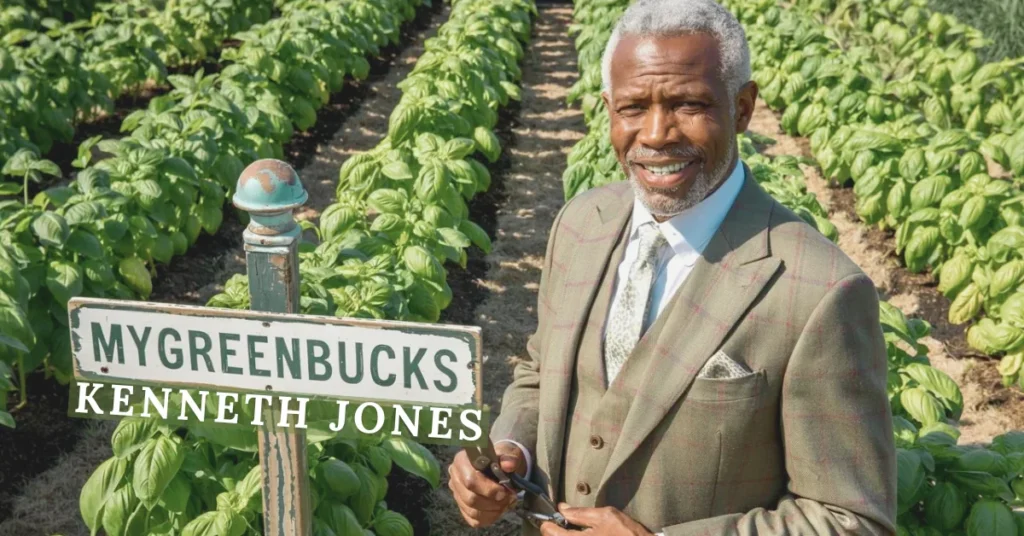

Sustainable finance isn’t just a buzzword—it’s the new backbone of forward-thinking investment strategies. With climate change, social inequality, and governance issues in the spotlight, money managers and individual investors alike are shifting toward green, ethical portfolios. And at the heart of this movement is MyGreenBucks Kenneth Jones, a pioneer committed to turning dollars into drivers of change.

Who Is Kenneth Jones?

Background in Finance

Kenneth Jones didn’t start in sustainability—he started in Wall Street. With a career spanning decades in traditional investment firms, he became well-versed in risk management, portfolio theory, and global market cycles.

Transition Into Green Economics

But everything changed when he saw the long-term damage short-term profits could cause. That’s when Kenneth Jones pivoted toward sustainable finance, founding MyGreenBucks to help bridge the gap between ethical values and financial gain.

The MyGreenBucks Mission

Financial Literacy Meets Sustainability

At its core, MyGreenBucks is about empowerment. Jones believes that every person, not just wealthy investors, deserves the tools to invest in a future that aligns with their values.

Empowering Everyday Investors

Whether you’re a student or a retiree, the platform provides simple, digestible financial education that helps users understand how their money can fight climate change, promote equity, and support responsible governance.

Strategies Driving the Shift

ESG Investing Principles

Environmental, Social, and Governance (ESG) is more than a checklist—it’s a framework for aligning investments with values. MyGreenBucks only promotes portfolios that score high across all ESG factors.

Climate-Conscious Asset Allocation

Kenneth Jones advocates a data-informed approach, directing capital to industries like renewable energy, sustainable agriculture, and eco-friendly infrastructure.

Divesting from Fossil Fuels

MyGreenBucks also makes it easy for users to avoid fossil fuel investments—one of the largest contributors to climate change.

Tools and Resources Provided by MyGreenBucks

Carbon Footprint Calculators

Ever wondered how your investments affect the planet? The platform offers tools that estimate the carbon output of your portfolio and suggest ways to reduce it.

Green Investment Portfolios

Curated by experts, these portfolios prioritize transparency, returns, and environmental impact.

Educational Webinars and Guides

Hosted by Jones himself and a team of sustainability pros, these resources simplify complex green finance topics for everyday users.

Key Partnerships and Collaborations

Nonprofits and NGOs

Jones has partnered with organizations that specialize in environmental justice, ensuring that MyGreenBucks’ actions align with scientific and humanitarian goals.

Financial Institutions Adopting ESG

Big names in finance are catching on. Kenneth Jones has led dialogues with major institutions to integrate genuine ESG practices—not just PR stunts.

Kenneth Jones’ Leadership Style

Visionary Yet Data-Driven

Jones balances idealism with pragmatism. He doesn’t just dream about a better world—he backs every decision with hard data.

Transparency and Accountability

Jones insists that MyGreenBucks stays 100% transparent about fees, investment logic, and partner vetting.

Community Impact of MyGreenBucks

Helping Marginalized Communities Invest Sustainably

Kenneth Jones doesn’t believe sustainable finance should be a luxury. Programs offer free financial literacy sessions and starter accounts for low-income users.

Real Testimonials from Users

“Thanks to Kenneth and MyGreenBucks, I made my first investment and feel confident it’s helping—not hurting—the planet.” – Maya, 27

Overcoming Greenwashing in Finance

How MyGreenBucks Ensures Authentic ESG Reporting

Not all that glitters is green. Jones has developed a proprietary ESG score system that’s stricter than most industry standards.

Tools for Detecting Misleading Investments

MyGreenBucks Kenneth Jones platform alerts users to “fake green” stocks and funds—so you don’t get tricked by buzzwords.

Regulatory Push and Market Trends

Global Trends Favoring ESG

From the EU to Asia, countries are tightening regulations to enforce sustainability. Jones keeps MyGreenBucks ahead of the curve.

How Jones Is Preparing MyGreenBucks

The company’s roadmap includes built-in compliance tools to help users meet global ESG reporting requirements.

Future Outlook

Kenneth Jones’ Vision for 2030

Jones imagines a world where green investing is the norm, not the exception—and where every dollar has a conscience.

Expanding to Global Markets

Next up? Europe, Africa, and South America. MyGreenBucks is preparing for global expansion with localized ESG criteria.

Why MyGreenBucks Is Different

Accessibility

You don’t need to be rich or a financial expert. MyGreenBucks is for everyone—from teens to retirees.

Tech-Enabled Sustainability

With AI-powered insights and blockchain-backed transparency, MyGreenBucks is built for the future of green investing.

How to Start Investing Sustainably

Step-by-Step Guide for New Users

- Sign up on the platform

- Take the ESG profile quiz

- Choose your green portfolio

- Monitor impact in real time

Top Green Sectors to Watch

- Renewable energy

- Sustainable tech

- Ethical consumer goods

- Waste management

Critics and Challenges

Addressing Skepticism in ESG

Some critics say ESG investing doesn’t deliver strong returns. Jones begs to differ—pointing to years of performance data from MyGreenBucks users.

Financial Risks vs. Environmental Gains

Jones argues that risk is everywhere—but doing nothing is the riskiest move of all.

Conclusion

Kenneth Jones isn’t just changing how people invest—he’s changing why they invest. In a world of greed and short-term gains, MyGreenBucks is a breath of fresh air. If you’re ready to align your wallet with your values, there’s no better place to start.

ALSO READ: Corpenpelloz: Pure Power for Mind-Body Balance

FAQs

Is MyGreenBucks only for eco-conscious investors?

Not at all. Anyone looking for long-term growth and impact can benefit.

How does MyGreenBucks vet ESG investments?

They use an internal score system plus third-party certifications and impact metrics.

What returns can I expect?

Returns vary, but MyGreenBucks aims to match or beat traditional indexes with less environmental cost.

Is there a mobile app?

Yes! Available on both iOS and Android, packed with impact trackers and tutorials.

Can I transfer existing investments to MyGreenBucks?

Yes, with portfolio analysis and conversion tools to green your current holdings.